Citizens often complain about taxes and government waste. If we suspected less of the latter, there might be less of the former. Yeah, maybe not.

Anyway, in thinking about this, it occurred to me that while I have read summaries and commentaries on the U.S. Federal Budget, I had never read the Budget itself – the actual source document. To develop a more informed view, I read the Federal Budget this Summer, in its entirety, with an aim to understand the layout, the process, the breakdown of funding, and to answer this question: Exactly where is the money going?

While reading through the Budget, I had some observations and key takeaways I thought worth sharing. And, to be transparent, I was a little disappointed with it.

The U.S. Budget

The Budget of the United States Government is a manageable 184 pages.1 Although text-dense and not a lot of fun to read, it’s reasonably digestible… IF you can wade through the first 47 pages of grandstanding, a monologue of incredible proportions dedicated to extolling the greatness of the Budget itself.2

Following the 47-page introduction and summary, the title of the main budget section captures the general sentiment and style of prose:

“ENSURING AN EQUITABLE, EFFECTIVE, AND ACCOUNTABLE GOVERNMENT THAT DELIVERS RESULTS FOR ALL”

According to the document itself, the Budget is heralded as the Best of All things to All people. It supports programs and people needing support, strengthens all things in need of strengthening, and modernizes all things outdated. It maximizes. It builds. It delivers. It manages. It helps. It promotes, values, ensures, addresses, fulfills, prioritizes, honors, bolsters, sustains, reinforces, invests, enhances, improves, and expands.

I lifted this small sample of opening words used in the bold sub-section headers. I feared the 863 contributing authors3 were at risk of depleting the entire inventory of hyperbolic English action verbs (then I noticed some of the better ones started to repeat).

Key Takeaway #1 – the U.S. Federal Budget is not written in a matter-of-fact manner as most budgets are, as I expected it would be. It’s written with an intent to convince the reader of a certain viewpoint.

Personally, I found the style off-putting and patronizing.

There’s also an Appendix, a separate document where the juicy details are buried under the weight of 1,400 pages. I kid you not.4

In addition, there’s a 332-page document called Analytical Perspectives, which contains the various assumptions and analyses used to forecast the long-term economic effects of the Budget. This part is actually well-presented and clearly written by analytical accounting and finance types and less by politicians.

Key Takeaway #2 – the Budget is very long. This isn’t surprising, given the size of the U.S. economy and all the specific allocations. But I found it unnecessarily long.

Nevertheless, I’m a data enthusiast and prefer to form my views directly from source documents when possible. Consequently, I laboriously plowed through it all, so you don’t have to.

Reading the Budget

I did not set out with a specific political agenda when I decided to read the Budget and its supporting documents. I was just reading out of general curiosity, with a notable, pre-existing concern for the U.S. debt and a desire to better understand how we construct and organize the nation’s budget and how we allocate capital.

Given my concern about the debt and a desire to understand spending priorities, I dug deep, even reading the footnotes. In doing so, I began to understand the problem with our spending plan and our entire Budgeting process.

Before we get into my thoughts on the Budget, let’s detour a bit to talk about the debt and the accuracy of the underlying assumptions used to create the Budget.

Debt Explained

Debt arises from cumulative annual deficits, which occur when spending (Outlays) exceeds tax revenues (Receipts). Debt therefore accumulates when the country spends more than it makes across multiple years.

It’s similar to your family budget. Consistently spending more than your income leads to bankruptcy or borrowing to make up the difference. The U.S. government chooses the latter, borrowing when there is a deficit.

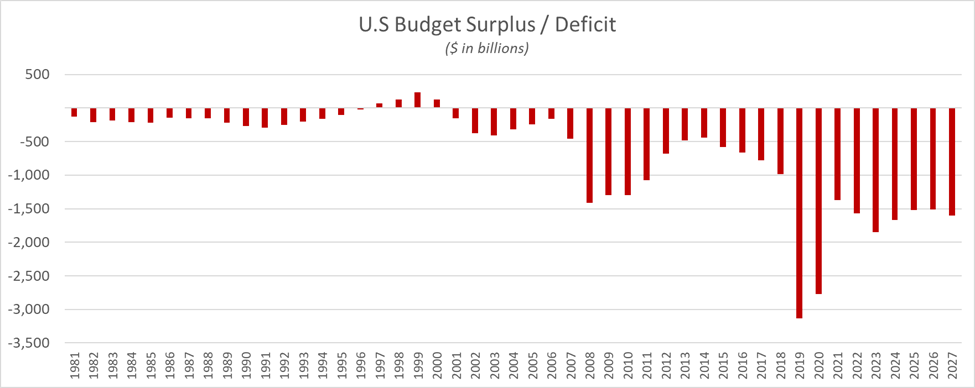

I created the chart below to show the annual Budget Surpluses and Deficits over time.5

Since 1981, the U.S. has had four small surpluses. All other years have been deficits. The negative bars essentially indicate the amount of money the U.S. government had to borrow to continue operations.

The out-years are projections (obviously). And they’re wrong.

We know the projections are incorrect because the government is extraordinarily bad at projecting accurately. We can see this by looking at the forecasts for past annual budgets and, with the benefit of hindsight, comparing past projections against the reality that unfolded over time.

Of course, making complex financial projections is no easy task. There are too many variables, both known and unknown. It is essentially impossible to make any meaningful forecast.

Accuracy of Underlying Assumptions (“Analytical Perspectives”)

When considering the long-term effects of the Budget on the economic health of the nation, the collective authors of the Budget must make some assumptions.

Key assumptions for the Federal Budget include things like:

- GDP Growth Projections

- Consumer Price Index Value Projections

- Future Unemployment Rates

- Future Interest Rates

…and similar metrics.

If you’ve ever built a financial model in Excel, you know the underlying assumptions are key, especially if you are forecasting more than just a few years. Multi-year forecasts compound any errors in your assumptions. The problem with compounding is that a small error in the underlying assumption, compounded over multiple years, becomes a big error quickly. That is, the longer the forecast, the more sensitive the model is to the accuracy of the underlying assumptions.

Here’s the good news. The U.S. government puts out a new Budget every year, for the next year. In doing so, they state the value of each assumption used for their calculations. To get an idea of how good the government is at making accurate assumptions, we can simply look back to the prior years, see the assumptions and resulting forecasts, and compare it to the actual values that we now know… because what was the future forecast projection is now the past.

<EXAMPLE>

The 2023 Budget (prepared in 2022) projects the Consumer Price Index (CPI – an inflation measure), to grow at 4.7% annually for 2022. Just one year later, the 2024 Budget (prepared in 2023) shows the CPI for 2022 actually grew at 7.6%.

- Assumption used for projections = 4.7%

- Reality = 7.6%

- Error = 62% (projecting just one year into the future)

Incidentally, the 2022 Budget (prepared in early 2021) showed the assumed CPI growth for 2023 at just 2.1%. This turned out to be 262% wrong (after just 2 years).

If the near-term CPI assumptions are significantly wrong, just one and two years out, there’s no way the CPI assumptions are remotely accurate across the 12-year projection made in the Budget.

Of course, you might argue these were particularly volatile times, due to Covid. But that’s precisely my point. The future will also contain volatility. We just don’t know why yet.6

</EXAMPLE>

Further, it’s not just the CPI forecast assumptions that have been significantly incorrect. It’s all the forecast assumptions. In fact, the Analytical Perspectives document, (which is like reading the footnotes to the footnotes), dedicates significant analysis to the accuracy of past projections and assumptions.

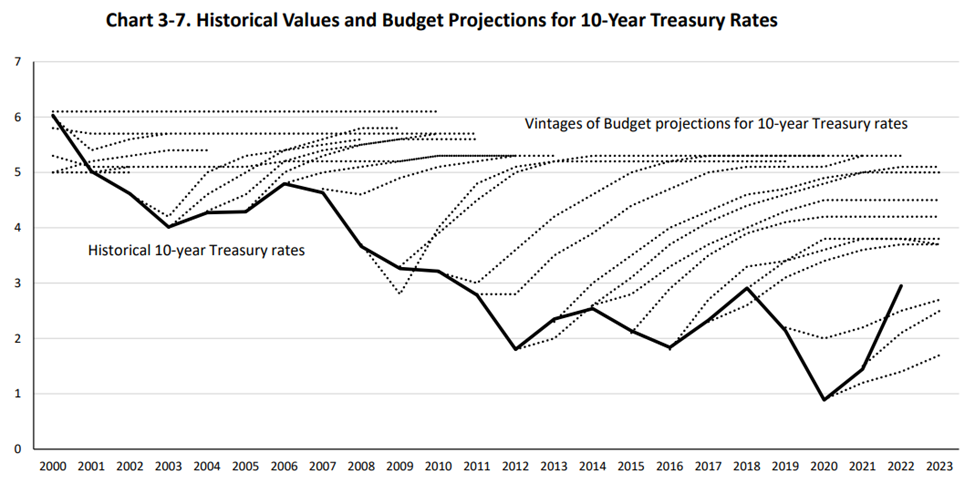

Here’s an interesting chart showing actual 10-Year Treasury Rates over time (solid line) compared to the forecasted rates made each year, for subsequent years (dotted lines). If forecasts were accurate, the solid line would map to the dotted lines.

Not a single projection accurately predicted reality even just one year out. By year three, the projections were wildly wrong. In fact, in November 2023 (the time of this publishing), the 10-year Treasury is 4.7%… which makes some of the older assumptions look better (accidentally) and the most recent 6 years of forecast assumptions look substantially incorrect.

Key Takeaway #3 – the underlying assumptions the Budget uses to drive their financial models are wildly wrong. Macroeconomics is simply too complex to forecast accurately.

Given this, we must assume that broad economic assumptions are nearly impossible to predict with any reliable accuracy. We should therefore place very little confidence in any forecasted numbers the U.S. Budget might project. I understand the Budget preparers should go through this exercise, to make some assumptions and run the models… but, we should not put any faith in the accuracy of the output. We’ll just assume these are academic exercises and not necessarily of practical value. This is a reasonable assumption.

My conclusion – the projected items presented in the “Analytical Perspectives” supporting document can largely be ignored. We can now focus our attention on the actual line items for proposed spending, my intention for the rest of this article.

The Budget Outline

The U.S. Annual Budget is presented in two main sections. The grandstanding introduction and the Budget itself. The Budget section is presented alphabetically by department (starting with the Department of Agriculture and ending with the Department of Veterans Affairs).

General Observations & Comments

This is not meant to be a comprehensive, line-by-line review of the budget, but rather my overall thoughts, having read it.

DISCLAIMER: While I prefer that my personal political leanings do NOT come through here, I suppose this is inevitable to some degree. That said, that’s not the goal. The goal is to provide a layperson’s view of the Budget and mention some concerns I developed while reading it.

You might have a particular affinity to the budgetary items that I question below. Please keep an open mind and realize I am not an insider into government budgets… just a guy who took the time to read it, form some opinions, and report out.

In my estimation, the U.S. Budget items fall into three broad categories:

Reasonable | Dubious | Ridiculous

There are a lot of dubious items and quite a few ridiculous items. Here are just a few as a small sample for you:

Ridiculous #1

On page 654 of the Appendix, I found this interesting funding allocation, in the fourth layer sub-heading.

- Department of the Interior

- Indian Affairs

- Operation of Indian Affairs

- Trust: Real Estate

- Operation of Indian Affairs

- Indian Affairs

$124 million allocated for…

Trust: Real Estate. – This activity promotes cooperative efforts with landowners for the optimal utilization, development, and enhancement of trust and restricted Federal Indian-owned lands. The activity includes general real estate services, probate, land title and records, environmental compliance, land acquisition, and other trust services and rights protection.

How ironic is it that the U.S. government has responsibility and funding to help manage real estate land title records for native tribes? Even better, the program has the word “Trust” in it.7

Ridiculous #2

When I constructed the master Excel sheet to track the CARES Act funding, I noted a special carve-out of funding for one single university.

Doesn’t it seem unusual that the only university that gets specific line-item funding in the U.S. Budget just happens to be the same university that received special funding from the CARES Act, which also happens to be located just a mile from Capitol Hill in Washington D.C?

I sense something amiss here.

Key Takeaway #4 – there’s a lot of unnecessary spending and questionable allocations in the Budget.

Ridiculous #3 – a general comment

Upon reading through all the funding pages, it becomes apparent that lawmakers have learned how to fund nearly anything by simply including one of these key phrases in the funding description, even if it doesn’t really make sense within the context of the department being funded:

- Climate Change (39 occurrences in the Budget Appendix)

- Carbon (90 mentions in the Budget Appendix… within the context of “sequestration” and “capture”)

- Equity

- Diversity and Inclusion

- Fairness

- Disadvantaged

- Environmental

- Minority

To be clear, I’m not suggesting these aren’t real issues, nor am I debating if they need attention or not. That’s not the point here. What I’m saying is, these words get tacked on to Budget line items where the fit doesn’t even make sense.

Why?

Because with these specific words, the budgetary line item for [XYZ] cannot get struck from the Budget. It must pass without question. No politician can vote to strike these specific items because it involves too much political risk. The author of the funding proposal will rant to the press that “Sally Smith, my colleague from across the aisle, is blatantly against [fairness/diversity/environment/etc.] because she tried to strike it from the budget. Is that the type of leader you want, someone who is against these important issues?”

And with that, Sally’s political career takes a devastating hit.

Instead, Sally has learned it is smarter to say nothing about [XYZ]. Instead, Sally collaborates with Bob to insert their own ridiculous line item into the Budget and claim it helps [carbon reduction/minorities/equity/etc.] as well. And with that, new parking lot stripes with a very special reflective paint only made by one supplier (coincidentally located in their state) must be applied to all Federal building parking lots to combat climate change.8

It’s a game politicians play. Here’s the formula:

Insert politically charged phrase into the budget to ensure funding. Use that budget line item to funnel money to your political donors and lobbyists who asked for the funding to be included in the budget. What’s a few billion here and there anyway?

Key Takeaway #5 – the Budget isn’t constructed to operate the U.S. Government efficiently and effectively. There’s a misalignment between the allocation of capital and the effective governance of spending, as measured by desirable outcomes. We could easily cut excess spending from the Budget without adversely affecting the central operations of the U.S. Government and the services it provides (or should provide).

Conclusion

The good news: we have a budget.

The bad news:

- It isn’t balanced, so it continues to increase the national debt to catastrophic levels.

- We don’t follow the budget anyway (because Congress can vote a special provision later to bloat it further or threaten to shut down the government).9

- The assumptions the government uses for financial forecasts are wildly incorrect.

- The Budget is full of wasteful, special-interest spending, to enormous proportions, at the expense of taxpayers.

Other than that, it looks pretty good.

P.S. Someone else please volunteer to read the next one. I’m not sure I’m up for it again.

Follow Past Midway if you would like an email notification of new posts.

FOOTNOTES:

- Because I read it this Summer, I read the 2023 Budget. The 2024 Budget is now available.

- The rest of the Budget is also blatantly self-aggrandizing, but at least there’s some meat to the text, starting on page 48, where we begin the first funding section.

- The Budget lists the names of the 863 contributing authors. I counted. Imagine trying to coordinate that!

- Do you think lawmakers read the entire 1,400-page Appendix in less than 24 hours, the allotted time they sometimes have before voting on it? No way. They just make sure their particular spending bit hasn’t been cut.

- Source Data

- And Covid had already happened during this period, and so had much of the money printing by the Fed. The Budget just failed to account for the resulting inflation, which should have been obvious to anyone with rudimentary knowledge of economics. This leads me to conclude there’s some political influence of the Budget forecasting process. That, or incompetence.

- The greater irony and likely reality – the U.S. government uses tax dollars to pay for title companies, likely owned by non-Native Americans, to provide subsidized title services for tribes as clients. The taxpayers likely overpay and get screwed. The tribes probably get screwed. The owners of these title companies get rich. And a politician secures a political donation. I really dislike sounding so jaded, but I think this is likely close to reality. If someone reading this knows more, please shed light on this in the comments section below. I’m happy to be wrong on this point.

- This is a fictitious example, but the fact that you thought it might have been real is itself a sign of the general level of distrust we have in our leadership.

- Well-written articles do not introduce a new element in the conclusion section that is not discussed and supported in the main document. I made this writing error here… and I don’t care. It’s still true.

I should also note that I write this post with a profound appreciation that I live in a country that allows me to write and publish a critical view.

Nice article Andy. The picture for the UK surplus/deficit is surprisingly similar taking a 40 year time horizon. I wonder what happened post the financial crisis 2007/8 that meant we never came close to balancing the budget even during the good years. Probably more than just perverse incentives as they existed before 2007. Maybe an increasing realization that there were many buyers for the debt even at the crazy high levels.

Thanks Selwyn. In the case of the U.S. during the years you mentioned, we were buyers of our own debt (through the Fed, the Social Security Administration, and other intragovernmental purchases).

I am still astounded that you actually read the document & I suspect that makes you a member of a very small group of people who actually care enough to do so. Perhaps my fav comment?…your last statement on comment #6.

Andy, as today is Thanksgiving, I’ll share one thing for which I am most thankful—and that is the moment a dozen or so years ago when I called you to introduce myself and asked whether you’d mind if I plagiarized your website’s structure, content, and wordsmithing—because I loved it all. Then knowing nothing about you, I only recognized that you formulate thoughts exceptionally well, you speak exceptionally well, and you write exceptionally well.

“Have you ever listened to a brilliant speaker and felt captivated by the music of their speech, the poetry of their words and the resonance of their voice? Then they probably have that magical combination that we call eloquence. Whether faced with giving a speech to an auditorium of thousands or simply addressing a group of colleagues, we all want to be able to express ourselves articulately, because it’s in that special zone of eloquence, that communication magic can happen.” [I didn’t write that: this person did.]

Every blog makes me smile and say ‘Yeah, that’s what I’ve been trying to say” (even though I’m only speaking to myself). I read your posts again and again, and I always anxiously await the next rambling to hit the site, so please keep them coming. Thanks for the Past, and I look forward to the Future. (As MOM said, ‘Well done yet again.’)

Jack – you are too kind. Thank you for the fantastic encouragement for this little blog hobby.