This is Part 3, the final part, in my series on the Fed.

Review

In Part 1, we discussed the Fed’s massive financial intervention into the mortgage-backed security market during the 2008+ recession.

During this time, the Fed pumped ~22% of a single-year’s GDP into the market, spread across six years.

Keep this figure in the back of your mind because we’ll revisit this enormous, unprecedented slug of stimulus as a size-comparison to the Fed’s financial intervention in 2020.

(Long) Side Note

This is a good place to insert a clarification I might have glossed over in Part 2.

In this series, we are discussing the economic activities of the Federal Reserve, which is different from the stimulus efforts provided by the Treasury Department. The Treasury sent stimulus checks to individuals and families, and PPP loans to businesses (through the SBA program, via banks). These are in addition to the Fed’s actions.

Unlike the Fed, the Treasury Department issues debt (in the form of bonds) to pay for the stimulus checks it sends. Bonds require future repayment obligations. The Treasury therefore has accounting in place to reconcile the money being handed out… in that it must be repaid (to the bondholders) at some future date. Consequently, when the Treasury doles out money, the National Debt increases.

Taking on debt is an attempt to reach into the future and pull some of the expected future growth (derived from investments in technology and innovations) into the present. In doing so, we effectively say,

“We’d like some of that future growth now. Let’s grab a handful and pull it into the present. Why wait, right? Sorry about that future-selves. I wouldn’t want to be those guys… or their kids.”1

The downside – debt adds to the nation’s future expenses, in the form of principal and interest payments, just like the mortgage on your house. The more debt, the greater our future payment obligations.

Too much debt is like buying too much house, the one you really wanted but couldn’t afford. In this situation, you cross your fingers and hope there are no surprise expenses or a sudden loss of income. Same idea with governmental debt. With a high debt load, there’s less room for error and less agility around negative surprises, like a pandemic, a polar vortex, or a conflict, for example.

Sub-Side Note – Commentary on Debt

It should come as no surprise the U.S. government robs growth from the future citizenry for the purposes of entitlement spending. After all, this is precisely how most Americans manage their personal finances. Through our mortgages, loans and credit card debt, we reach into the sweet honey of our future earnings, grab a wad of cash and accelerate our present consumer purchases. It stands to reason we behave collectively much the same as we behave individually.

Repeated warnings of debt-load concerns fall on deaf ears at the congressional level. As if we need proof of this, here’s an interesting quote I lifted from the Government Accountability Office (GAO) Financial Audit (published in November 2020):

“Absent action to address the growing imbalance between spending and revenue, the federal government faces unsustainable growth in its debt. Since 2017, we have stated that the federal government needs a long-term plan to help put it on a sustainable fiscal path.“

– United States Government Accountability Office. Report to the Secretary of the Treasury. Financial Audit. November 2020

Governmental budgets are delicate, politically charged topics. The GAO wouldn’t write anything in this report without fully thinking through the ramifications of tone and demeanor in its prose. Accountants choose words carefully in audits.

One phrase in the quote above stands out to me. Perhaps it caught your eye too. It’s the phrase “Since 2017”.

Interpretation: “We’ve told you repeatedly, for years, and we are telling you again in this report. Our budget is on an unsustainable path. Without intervention, it falls apart. And if it does, you cannot say we didn’t tell you… because we have told you, multiple times… Since 2017. You are now accountable.”

The GAO is leaning into the “A” in its namesake. That’s what “Since 2017” means. Even with carefully chosen words, it’s a dire warning, couched in no uncertain terms.

End Sub-Side Note (and back to the original Side Note)

In contrast to the Treasury, the Fed magically creates money without an associated IOU note. Thus, no additional debt is created. This “creating money out of thin air” is why the Fed’s balance sheet goes up as it buys assets, like mortgage-backed securities and U.S. Treasuries (explained in more detail in Part 2).

The Fed does not repay that which it created, it only expands and contracts its balance sheet, a consequence of buying and selling assets. But in expanding its balance sheet, the Fed devalues the currency.

How?

The Fed fabricates fictitious dollars to buy stuff (assets). It then puts these assets on its balance sheet (to show it owns them). But the fabricated dollars went to the entity that sold the assets to the Fed (usually a bank). This entity (a bank) then lends out these same dollars (leveraged) to its customers (often a business) who would like to borrow money. The borrower then uses these same dollars (leveraged) to buy other things in the real economy. And thus, these fictious Fed dollars spider through the economy, adding to the total dollars floating about (electronically speaking). Once the Fed puts them out there, they are no longer fictitious. They are just as spendable as any other dollar. Some of them might even end up in your bank account.

Consequently, when the Fed buys assets, there are instantly more dollars than there used to be.

Supply & Demand. More supply, less scarcity, lower value. Basic economics.

This is the stuff we were meant to learn in 8th grade economics class, but instead we were throwing paper wads at each other. At least, that’s what we did in my class, in between not paying attention.

To be clear, the Fed can also reduce its balance sheet, but in doing so, the economy will tend to contract because this action reverses the process and pulls dollars out of the economy.

How?

Well, the Fed looks at some assets on its balance sheet and says,

“Hey, any of you guys want to buy some of this stuff we have over here?”

Eventually, someone happens along the Fed’s garage sale, shopping for a bargain.

“What’s in that basket over there in the corner?”

“That’s uhh. Well, uhh, that’s a mix of a bunch of stuff. Tell you what, I’ll let you have that whole basket of stuff for $100 million dollars.”

“Deal.”

With this exchange, the basket of stuff leaves the Fed’s garage, and the buyer leaves the Fed some dollars. A lot of dollars. The Fed then just erases those dollars, eats them, burns them, deletes them (electronically), whatever, and the Fed’s balance sheet declines… because the dollars are now gone… and so is the stuff. Gone from the Fed’s balance sheet. Gone from the economy at large. Magic.

Now there are fewer dollars in existence.

Again, basic economics. More scarcity. Greater value (per dollar)… but less money floating around to spend.

With fewer dollars floating about, there’s less buying of stuff in general… because, all things being equal, people buy stuff when they have money. And, people generally have more money when there is more money to be had. The flow of money (the velocity of circulation) is also important for the health of an economy.

In this case (the removal of dollars case), the supply and demand equation works against us… and the economy contracts (but maybe our dollars are worth more). We could think of this as still paying for the stimulus (like debt), just in another way – the economic contraction is the payment for the luxurious sins of our past money printing.

In reality, the Fed has difficulty selling its stuff without the economy wanting to decline. Politicians do not like the economy to decline. Certainly not close to an election year. The Fed therefore has an inherit (politically driven) bias to encourage the economy unidirectionally… up. Because of this bias, the Fed’s balance sheet continues to grow, which devalues the currency. Inflation is a natural consequence. This phenomenon is more math and physics than art. Basic math.

Sub-Side Note 2 – Value of a Dollar

Another clarification: many people think devaluing the currency means relative to other currencies. While this may also be true, it’s not the only consequence. Devaluing the currency reduces the purchasing power of the dollar, relative to the goods and services the dollar purchased in the recent past.

Inflation isn’t that prices go up. It’s that the dollar goes down.

The dollar now buys less of the same stuff it used to buy. The value of the stuff didn’t change (much), it’s just that, with inflation, it now takes more dollars to buy that same stuff. The net effect is, it feels like prices have gone up. Certainly, the sticker price has changed. But this is largely because it’s more practical and economical to change the sticker price of products electronically than to change the packaging to reduce the quantity of the stuff in the bag, box or container.

A Story…

We had chickens when I was growing up on the farm in Oklahoma. Not many, but more hens laying eggs than our family of four consumed on our own. Mom advertised our egg abundance with a hand-painted sign, white letters on a dark red background (good choice for eye appeal), placed at the end of the driveway. Anyone driving by (on the dirt road) could see:

Eggs

$0.35 / dozen

This was circa 1980. Now, some 40 years later, a dozen farm-fresh, organic, free-range eggs cost ~$6.00… about $0.50 per egg. That’s inflation.

For practical reasons, the grocery store still sells eggs by the dozen… because that makes more sense than selling mini-packages of ¾ of a single egg for the same historical price of $0.35. The point here is, we keep the package at a dozen and increase the price rather than keep the price and reduce the quantity of goods delivered.2

End Sub-Side Note 2 (back to the original Side Note again)

So, this is how the Fed creates dollars and spurs the economy, but at the expense of inflation… and vice versa.

Going back to the Fed’s stimulus verses the Treasury’s stimulus…

Both actions are of concern (over-burdening future taxpayers with debt and/or devaluing the currency).

The first case (debt) is visible and traceable. We can look online and see the national debt and the interest we pay as a percentage of our annual budget or as a percentage of GDP. But debt burden is less felt in the short-term. Consequently, debt burden gives off a we’ll-deal-with-it-later kind of vibe. The problem is, it is now “later”.

The second case (devaluing the currency) is less tangible conceptually, like an undercurrent that slowly pulls us to deep water. Nevertheless, we feel its effects in our daily lives. We see it at the grocery store and when we go out to eat. A burger and fries for lunch used to be $7. Then it crept up to $10, over time. Maybe now it’s $17 and will soon be $25. Then $50.

Anyone who doesn’t think we are already experiencing significant inflation hasn’t been out to eat lately… or hasn’t been talking to people in construction. Those in construction directly feel the effects of increased prices of raw building material, like lumber.

The graph below shows the price of lumber over the past 25 years.3

Notice anything unusual there at the end?

End (Long) Side Note

Continuing our Review. Yes, we are still in the Review section… I know.

In Part 2, we followed the Fed from 2010 – 2019. During this period, the Fed continued to balloon its balance sheet, took a brief pause, then tried to sell some of those acquired assets, unsuccessfully.

As the Fed tried to reduce its balance sheet, even a little, the most predictable thing happened, the economy wanted to contract (precisely as discuss above). This is apparently unacceptable, going into an election year. Consequently, the Fed reversed its position and bought the assets back. Thus, most of the assets from the last recession remain on the Fed’s balance sheet, some 11 years later, and another round of stimulus begins (early 2020) and another later in 2020, and yet another (early 2021), all before we can unwind the previous stimulus from the last recession.

Our successive (and excessive) economic stimuli are starting to pile up.

The natural consequence is inflation.

It’s like the criminal who printed so much counterfeit currency that $20 bucks just wasn’t worth $20 bucks anymore, so he had to print more to maintain his lifestyle.4

Part 3

In this last part of the series, I want to focus on the Fed actions of 2020.

Let’s resume our storyline…

Early 2020

If you’ll recall, January and February of 2020 were stellar months for the overall stock market. Meaning, it was going up. Not necessarily because it should have, from a fundamentals perspective, but because the Fed was dumping so much money into the system.

And then the world seemed to spiral out-of-control, in so many ways, but we’ll stick to the economic discussion.

Stimulus #1

On March 23, 2020, the Federal Reserve announced a new operating policy titled:

“Statement Regarding Treasury Securities and Agency Mortgage-Backed Securities Operations”

This official-sounding announcement communicated, effective that same day, the Fed would,

“…conduct operations totaling approximately $75 billion of Treasury securities and approximately $50 billion of agency MBS each business day this week…”

– Source

In this case, “conduct operations” meant “buy”.

The main point here is the Fed decided to substantially increase its purchasing activities, and therefore its balance sheet as well,

“These plans replace the Desk’s previously communicated plans for Treasury purchases of at least $500 billion over coming months.”

– Source

Why Does This Matter?

Well, purchasing $75 billion per day is a significant increase from the already planned initiative to buy $500 billion over a few months. In other words, to put out the fire, the Fed went from a garden hose to a fire hydrant (with $500 billion over months), to opening the flood gates (with $75 billion per day).

How does this compare to the 2009+ recession (because I said in Part 1 that we would come back to this)?

The Fed committed to buy $100 billion per month in 2009.

In 2020, the Fed committed to buy $75 billion per day.

This is roughly a 22x increase in the velocity of the creation of faux-dollars, compared to the last recession.

Keep in mind, 2009 was unprecedented and a huge financial intervention on behalf of the Fed.

March 2020 – Updated Fed Policy – Expanding Further

In another unprecedented move, the Federal Reserve announced in March 2020 that, in addition to purchasing U.S. Treasuries and mortgage-backed securities, the Fed would also support corporate bonds.

I don’t think the Fed had a mandate to do this, so I’m not entirely sure this was legal… but I guess it was, since it happened.

To prevent the Fed from selecting specific companies, which would be unfair (and would surely lead to accusations of corruption), the Fed decided to buy corporate bond exchange-traded funds (ETFs). These ETFs represent a basket of corporate bonds. This spreads the Fed purchases across numerous companies.

Why Buy Corporate Bonds?

In purchasing shares of these bond ETFs, the Fed also added money supply to these ETF funds. When ETF’s experience a net inflow of money, they have a higher net asset value for which they need to purchase more corporate bonds to grow the portfolio assets commensurately. In doing so, these funds add to the buy-side for corporate debt.

More buyers equate to lower rates required to attract investors. In effect, this lowers the interest rates corporations pay to borrow money, thus incentivizing them to borrow more and invest those borrowed funds to grow their companies and fuel the economy. That’s the idea anyway.

Pushing more money into these large investment-grade companies resulted in lower yields on corporate debt (lower interest rates). This pushed some investors, looking for higher yields, into either lower rated corporate bonds, preferred shares, or equities that pay good historical dividends. This pushes investors in these assets down the line of alternative investments and so on. In other words, the Fed dollars trickled through the spectrum of investment options. And that is precisely what we saw in the market. All these asset classes have been boosted as the Fed dollars move through the economy.

Clearly, the Fed moves the market. Why else would the equities markets go up during a global pandemic? That doesn’t make sense without the Fed’s intervention, which acted as an unnatural, external force to sway the balance of supply and demand. But, again, at the expense of inflation.

The Fed’s Balance Sheet

Compared to current Fed actions, the 2009-2010 purchases were just round-off error… and that was a “financial crisis”. This should shed some light on the depths of the Fed’s financial response to the COVID-19 pandemic. The Fed’s actions are unparalleled in proportion.

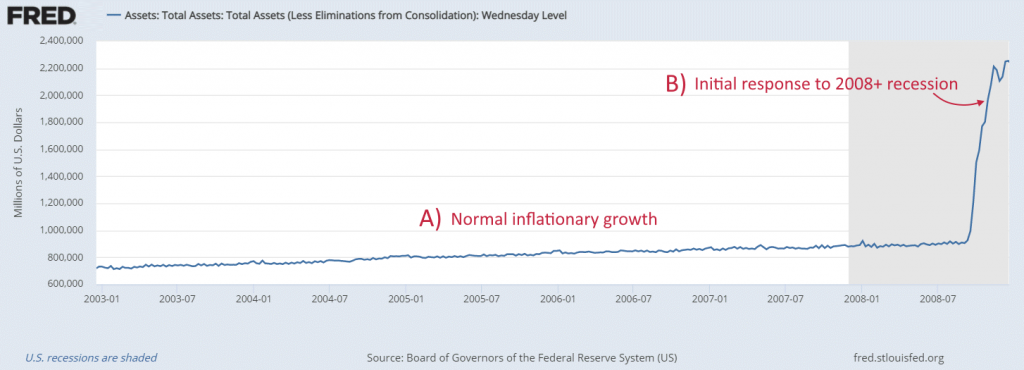

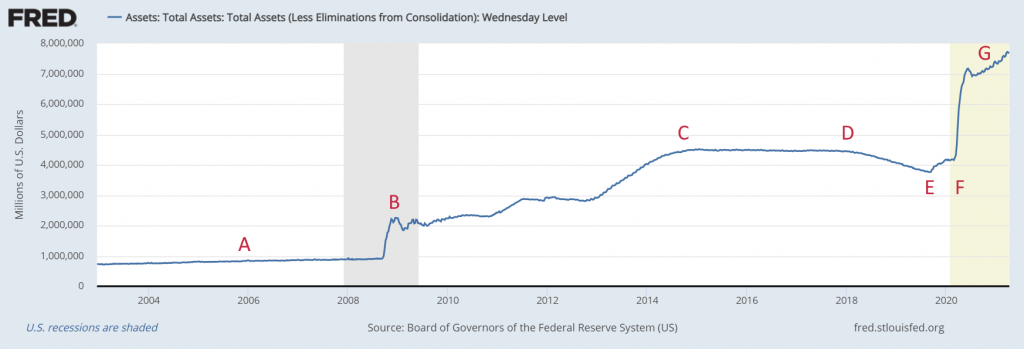

Here’s what the Fed’s balance sheet looks like over time, presented in two graphs to give a better sense of scale: 5

2003 – mid-2008

Notice how huge the Fed’s stimulus was in 2008-2009, compared to the historical Fed balance sheet.

2003 – March 2021

Key milestones:

A) Fed balance sheet growing subtly and predictably, approximately at the rate of inflation.

B) The 2008-2009 recession. The massive Fed stimulus is shown in this hump, eventually rising to point C.

Notice how large the jump is to point (B) in the first graph… but on the scale of the second graph, this huge jump up looks much smaller. This provides visual context for how bloated the Fed’s balance sheet has become since 2008.

C) End of the Fed stimulus from the last recession.

D) Fed begins to reduce its balance sheet.

E) Market falters and Fed starts to buy back.

F) Covid stimulus (March 2020).

G) Fed continues to stimulate the economy.

H) Not shown… 2021 stimulus package.

Keep in mind, we’re not discussing this is terms of the national debt (which is also in crisis), we’re just talking about the Federal Reserve’s balance sheet.

Why Not Provide a Stimulus?

This is a good point to ask the obvious question – how could we NOT provide an economic stimulus, given the circumstances of a global pandemic?

But that’s the wrong question.

The question we should ask is, why didn’t we have our economic house in order BEFORE the pandemic. Way before.

When Covid hit, we had few economic options at our disposal. Why? Because we already spent everything in advance, juicing our economy, even during favorable economic times. We spent some of the future before it got here, running a substantial deficit year-after-year.

In addition, the Fed artificially suppressed interest rates to further stimulate the economy for the past decade. By massively stimulating the economy in the years before the pandemic, even when we didn’t need to, we didn’t take a season of austerity from our prosperity to reduce debt and setup a “rainy day fund”, something to fall back on, if needed.

When individual households operate like this, they are living on the edge, just one small mistake or one unfortunate surprise from bankruptcy. The same concept applies to governments. In other words, this is of our own doing. We were so keen to juice the economy, we had little recourse when an emergency occurred.

Should we encounter another unusual event or catastrophe, there’s really nothing left to do, except more of the same. Maybe, just maybe, we have one stimulus left in us. Maybe.

This is not a smart way to run your personal finances. And it’s not a smart way to operate a governmental budget, for the same reasons. When a family or individual holds too much debt, lenders require high interest rates, commensurate with the increased risk of default. At some point, the risk is simply too high. No reasonable interest rate will satisfy the lenders’ concern of a possible default. The same thing can happen to countries. We simply can’t stimulate indefinitely.

What Can We Do About It?

I hate to say it, but the best policy here might be the old saying… if you can’t beat ‘em, join ‘em.

Holding more cash than normal for fear of investing in an over-priced stock market is only reasonable as a short-term strategy in an inflationary environment. In the medium- to long-term, inflation will seriously erode the purchasing power of that cash. Instead, we should aim to park our cash in appreciating assets, with as much fixed-rate debt as possible, for the longest duration of debt you can find.

If you can afford to not have cash flow from your investments, raw land might be one of the best assets for this investment era. It tends to appreciate over time, and you can lock in a 30-year, fixed-rate mortgage on the purchase. The idea is to lock in these historic low mortgage rates for as long as possible (30 years). This strategy is essentially interest rate arbitrage over time. Buy and hold… for a long time.

If the Fed is going to print money and devalue the currency, this means the price of assets (like land) should increase, in dollar terms… but the debt does not increase. We essentially get to pay back our borrowings with dollars of less value. Interest rate arbitrage.

Said another way… inflation reduces the value of the dollar. If this is the case, it simultaneously reduces the value of dollar-denominated debt. Borrow at a fixed rate and watch inflation erode what you owe.

This is precisely the strategy the U.S. government is employing to inflate our way out of our massive debt overhang.

Alternatively, consider investing overseas (in non-dollar denominations) or moving money to countries (in their local currency) to places that haven’t printed so much money as a percentage of their GDP. Ideally, places that also benefit from the global economy and outsourcing. Places like Cambodia, Vietnam, Georgia (the country, not the state), Mexico and China.6

If you are feeling frisky, invest in real estate outside the U.S… but do your homework thoroughly on this front.

Wrapping Up – Fed Up

The Fed’s expanded role in economic affairs now drives the entire market. This begs the question: do we still operate and invest in a free-market economy?

The answer depends on what we mean by “free”.

If we mean individual actors have free will to buy and sell as they so choose, then yes, the financial markets are free in that sense. That is, it is neither compulsory nor exclusionary.7

But if we mean the financial markets are free to discover their true market value based on raw supply and demand of individual free agents acting independently, but collectively, upon the market, then no, the market is not (completely) free in that sense.

There’s one out-sized actor – one with undue influence – precisely because of its size. Consequently, the pricing of securities is not based on the collective view of numerous independent agents, each with different views about the return-on-investment prospects of individual stocks, and, collectively, on the market as a whole. Instead, the supply-and-demand balance is greatly influenced by the actions of a single player. This player changes the demand-balance at will, usually biased unidirectionally (upward).

But it’s more complicated than just altering the supply and demand equation, because this one actor has unique properties. Its actions also affect the value of the underlying currency the rest of us use to purchase securities. This unique, currency-value-altering-property from this one actor, in turn, influences the rate we use to discount future cash flow projections from our investments back to present value to calculate return on investment.

That is, with inflation, we demand a higher rate of return (to outpace inflation). We therefore discount future cash flow projections of our underlying investments to a greater degree, making them worth less today than they otherwise would be. EXCEPT… maybe not, because, in pumping money into the economy, maybe we also need to reflect this stimulus into our future cash flow projections of those investments. This is extremely convoluted and next to impossible to work out.

Here’s an analogy:

The market’s process of price discovery (balancing supply and demand) is much like a game where we place a large number of people on either side of a long table. The team on one side is the buy-side. The team on the other side is the sell-side. In the middle of the table is a cotton ball. Each person, on each side of the table, is given a straw, of various sizes, to blow at the cotton ball. If more people are blowing from the buy-side, or if the buy-side players have straws of larger diameter or larger lung capacities, the force on the cotton ball is no longer equal-and-opposite. Consequently, the cotton ball travels across the table, toward the sell-side. As the cotton ball gets closer to the sell-side of the table, the force from the sell-side’s collective straws begins to balance out and the cotton ball finds a new point of equilibrium.

The difference is, when the Fed steps in to play this game with the rest of us, the Fed brings a leaf blower… and a jet engine to fire up on special occasions.

This isn’t a bad analogy really.

It’s not that the game is rigged, because you can freely choose which side of the table you want to play on… but the game is significantly biased… on the buy-side, since the Fed has an up-market bias.

If the goal is to win the game, and you get to choose which team to play with, you’d be smart to play on “Team Leaf-Blower”.

This is summarized with the investment advice, “Don’t bet against the Fed”.

Dropping the analogy…

Because the Fed brings overwhelming volume to move the market (purposefully), the market is no longer allowed to discover true valuation, based on rigorous fundamental analysis. Instead, the financial markets are forced to play political dynamics that insist on continual upward trajectories, at the expense of the value of the dollar, and at the expense of the next generation.

But to end on a more positive note, I’ll reiterate the idea above. I believe there is wealth to be secured for those willing to take a risk and purchase appreciating assets now, borrowing as much as possible, locking in these historically low interest rates, and holding for the long term. Interest rate arbitrage across time.

Final Disclaimer: nothing contained herein is meant to be financial advice… just my personal speculations. In fact, if you do the opposite of what I suggest, you might even make money.

Related Posts:

Follow Past Midway if you would like an email notification of new posts.

FOOTNOTES:

- There is a valid economic argument for debt… if we raise debt at X% interest rate and use those funds now to invest in technology, education, research and infrastructure, we might accelerate our future economic growth in excess of the cost of debt. Thus, the debt can pay for itself, plus some. If we make capital investments that create a positive return-on-investment, we can come out ahead. We create value by accelerating our future wealth creating abilities through investments in the present, for the future. This can work beautifully… IF the funds are used as investments into our future productivity.

But is that how we use our debt, for investment purposes? Typically, no. More precisely… almost never. Instead, stimulus checks most often accelerate consumer spending. People get a little money, go shopping and buy stuff… a new outfit, an iPad, a few nice meals at a restaurant. These are not investments. These are expenses. Stimulus funds spent on items like this circulate money, but there is little return-on-investment… and we find ourselves a little further in the hole with regards to our ability to invest in our future economy because the resulting interest and principal payments on our debt become a larger slice of tax revenue in the future years.

- My editor strongly suggested I delete this section… citing it as “too off-topic”. But author’s prerogative insisted it stay because I liked the chicken story from my childhood. Besides, it’s likely the only thing you’ll remember from this entire blog post… that we had chickens. (It’s worth noting, I am also the editor, so this was more of an internal dialog).

- Source.

- When the Fed prints money, it’s not “counterfeiting”. It’s “quantitative easing” – official, electronic counterfeiting, at scale.

- Source: Board of Governors of the Federal Reserve System

- DISCLAIMER: Do your own research and, whatever you do, don’t follow my strategy. You’ll lose money and blame me… and we don’t want that.

- With one exception, investing in the market assumes you have discretionary funds to invest. Currently, only 52% of American hold investments in the equities market and only 14% hold direct investments in individual companies. Most Americans who hold stock are invested through a mutual fund or through their retirement plans. – Source.

Once again excellent. Seems to be a lot of conversation lately about inflation and where the markets going and how it relates to politics. But, I feel that most people have no idea what they’re talking about and are looking to blame a political party. This is a great ending to a series. Very education. thanks for sharing!

I found this 3 part series very educational. I enjoy your articles very much. I always learn a great deal. Thanks for including me.

Thank you for the nice feedback. I appreciate it.

As before, a well reasoned paper. I always learned more reading your articles. I did not know the difference between Fed & Treasury. Thanks, again.

Thanks for reading… and for your feedback Mike. Good to hear from you.