When possible, I prefer to read original source documents for my research, rather than summarizing secondary or tertiary sources. Consequently, I read the entire 880-page Senate amendments to the CARES Act1 yesterday and today.

I made summary bullet points as I read. Accidentally, this became a 7-page condensed version with 175 succinct points, a line-by-line accounting of where the money is allocated,2 not just the 4 or 5 main points you’ll read in the news.

I thought I’d share in case others are interested in exactly where we are spending $2.2 trillion. If you find this interesting, or helpful, or if you have thoughts, please leave a comment. Reader comments are the best part of my blog.3

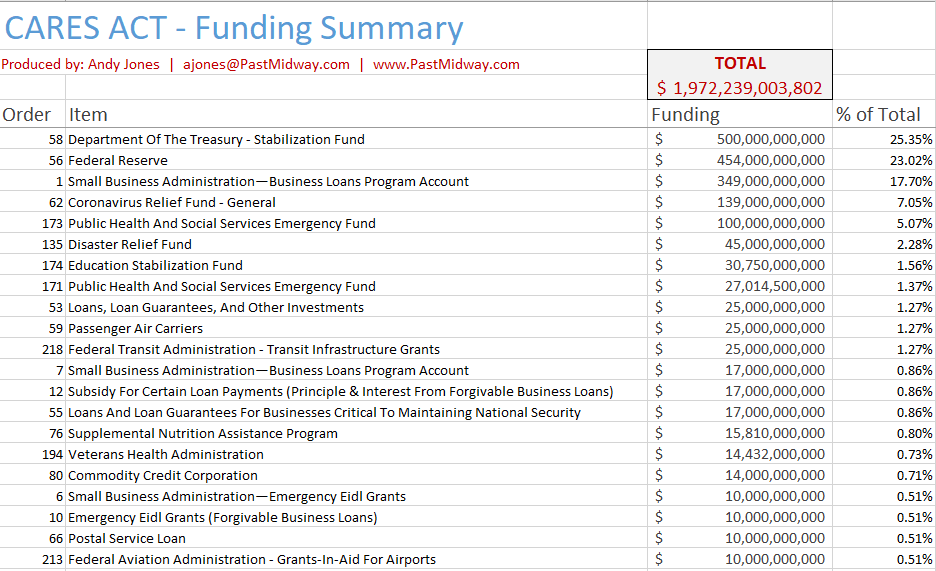

UPDATE INSERT (March 28, 2020) – Based on the responses to the original post, I combed through the final signed CARES Act and put all the funding provisions into Excel, 234 entries. This allows us to sort by amount and, frankly, check the math to ensure it sums to $2.2 trillion, just for fun.

It doesn’t.

I show the sum as $1.972 trillion.

Although I was painstakingly methodical, perhaps I missed a key point… but did I miss $227 billion ($227,760,996,198)? That would have been the 4th largest value in the entire document.

Here are the funding provisions in order from largest to smallest for everything $10 billion or more (the total includes all 234 items).

My summary (below) contains no personal editorial, although I do have some opinions on the matter, as will you, if you read through all the provisions for funding. Most notable, and I have been asked this, so I will just say it upfront…

Yes, the House of Representatives did in fact allocate $25 million for themselves for “Salaries and Expenses”. Buried on page 781. That said, it’s no more than the $25 million allocated to the JFK Center for the Performing Arts and only a third of the $75 million allocated to the National Endowment for the Humanities.

Meanwhile, the Senate slipped in $10 million for themselves. The main difference from the House is not the amount, it’s the clever title: “Contingent Expenses of the Senate – Sergeant at Arms and Doorkeeper of the Senate… and Miscellaneous Items”. That’s considerably more palatable than “Salaries” and has therefore seemed to escape notice.

The Act is structured in two main divisions:

DIVISION A – KEEPING WORKERS PAID AND EMPLOYED, HEALTH CARE SYSTEM ENHANCEMENTS, AND ECONOMIC STABILIZATION

This part contains most of the stuff you really care about because it might impact you directly.

DIVISION B – EMERGENCY APPROPRIATIONS FOR CORONAVIRUS HEALTH RESPONSE AND AGENCY OPERATIONS

This part contains most of the stuff you don’t care about but should, because it impacts you indirectly. More accurately, it impacts your children and grandchildren, who will pay for it.

In general, Division A promises direct payouts to individual citizens and businesses while Division B allocates money to governmental programs and other organizations. Some of the funding might surprise you. You might even wonder how some of it relates to the coronavirus. In some cases, it simply does not.

You be the judge.

My outline below follows the Act in the order it unfolds, with source page numbers denoted.

DIVISION A – KEEPING WORKERS PAID AND EMPLOYED, HEALTH CARE SYSTEM ENHANCEMENTS, AND ECONOMIC STABILIZATION

Business Loans (page 9)

- Average monthly salary for U.S. employees and contractors times 2.5… excluding employees who earn more than $100,000 per year

- No personal guarantee

- No collateral

- No origination fees

- 4% max rate

- No payments for 6 months (maybe up to 12)

- No prepayment penalty

- Max loan = $1 million

- To qualify, you only need to have a decrease in receipts or customers

- Loan forgiveness for any expenses for payroll

- Exemption for re-hires (from Feb.15 – April 24)

Loan Forgiveness (page 41)

- Debt forgiveness for business expenses related to: payroll costs, mortgage interest, rent, utilities

- Reduction in loan forgiveness prorated with any reduction in average number of full-time employees or reductions in employee average salaries

Individuals (page 144)

- $1,200 per adult + $500 per child tax credit

- Starts to taper off at $150,000 if filing jointly ($75,000 individually)

Retirement Funds (page 157)

- Take up to $100k out of retirement funds without penalty for Covid-19 expenses.

- No minimum required distribution from a retirement plan for 2020

Stockpiling Health Supplies (page 217)

- Respirators & pharmaceuticals

- Pharma companies required to develop a risk mitigation plan for drug manufacturing and ingredient sourcing (annually)

Coverage of Diagnostic Testing for Covid-19 (page 233)

- Health insurance required to cover “any qualifying coronavirus preventive service”

Health Care Providers – $1.32 billion (page 236)

- For the “detection of SARS-CoV-2 or the prevention, diagnosis, and treatment of COVID-19”

Suspension of Interest on Student Loans (page 333)

- For the period of emergency

Limitation on Paid Leave

- Employer not required to pay more than $200 per day ($10,000 max) for paid leave

Limitation on Paid Sick Leave

- $511 per day ($5,110 total)

Review of Non-Prescription Sunscreen Active Ingredients (page 470)

- I didn’t make this up

Loans to Eligible Businesses – $500 Billion (to provide liquidity)

- $25 billion in loans to passenger air carriers

- $4 billion to air cargo carriers

- $3 billion to air carrier contractors

- $17 billion for businesses critical to national security

- $454 billion to provide liquidity to the financial system that supports lending to businesses, states and municipalities (page 512)

- Only allowed if the government receives a senior debt, warrant or equity position

- No loan forgiveness allowed for these loans

- Limitations on compensation for employees who make more than $425,000 (for companies receiving loans) and to employees who make $3 million+ (new compensation capped at 1.5x 2019 compensation)

- Community bank leverage ratio relaxed to 8%

- Multifamily Residential Owners – forbearance for loan payments (30 – 90 days forbearance of loan payments)

- Temporary moratorium on eviction filings for 120 days (page 575)

Coronavirus Relief Fund

- $150 billion total

- $3 billion for districts (DC, Puerto Rico, Virgin Islands, Guam, Mariana Islands, American Samoa)

- $8 billion to tribal governments

- The remainder gets distributed to all 50 states, prorated based on population… with a minimum of $1.25 billion per state.

- Funds must be used for COVID-19 expenses

- $35 million allocated for oversight

Borrowing Facility for U.S. Postal Service (page 607)

- Up to $10 billion

DIVISION B—EMERGENCY APPROPRIATIONS FOR CORONAVIRUS HEALTH RESPONSE AND AGENCY OPERATIONS

Coronavirus Health Response (page 609)

- $9.5 billion specifically for agricultural producers, farmers markets, restaurants, schools, livestock producers and dairy producers

Miscellaneous Funds to the Justice Department (page 624)

- Some smaller amounts, ranging from $2 – $15 million each to: US Attorneys office, US Marshall Service, FBI, Drug Enforcement Administration

- Federal Prison System – $100 million

- State and local law enforcement – $850 million

- NASA – $60 million

- National Science Foundation – $75 million

- Legal Services Corporation – $50 million

National Guard (page 640)

- Army – $746 million

- Air Force – $482 million

- Army Operation & Maintenance – $160 million

- Navy Operation & Maintenance – $360 million

- Marines – $90 million

- Air Force Operation & Maintenance – $155 million

- Army Reserves – $48 million

- Army National Guard – $187 million

- Air National Guard – $75 million

- Defense-Wide – $827 million

- Defense purchases – $1 billion

- Defense working capital – $1.45 billion

- Defense Health Program – $3.8 billion

- Office of Inspector General – $20 million

Corps of Engineers (page 652)

- $70 million

Department of the Interior (page 653)

- $20 million

Department of Energy (page 654)

- “Science” – $100 million

- Departmental Administration – $28 million

- Nuclear Regulatory Commission – $3 million

Department of the Treasury (page 659)

- Internal Revenue Service – $250 million

- Supreme Court – $500,000 (for additional salaries and expenses)

- Court of Appeals, District Courts, other – $6 million

- Defender services – $1 million

- District of Columbia “Emergency planning and security costs” – $5 million

- Election security grants – $400 million

- FCC – $200 million

- Federal Building Fund – $275 million

- Federal Citizen Services Fund – $18 million

- Working Capital Fund – $1.5 million

- National Archives – $8 million

- Office of Personnel Management – $12 million

- Pandemic Response Accountability Committee – $80 million

- SBA Disaster Loans Program Account – $562 million

- Provision for public oversight of these Coronavirus funds. “not later than 30 days… the Committee shall establish and maintain a user-friendly, public-facing website to foster greater accountability and transparency in the use of covered funds and the Coronavirus response, which shall have a [URL] that is descriptive and memorable. (Page 690) [Andy’s Note: it will be interesting to see if this actually happens].

Department of Homeland Security (page 689)

- Operations and Support – $178 million

- Transportation Security Administration – $100 million

- Coast Guard – $141 million

- Cybersecurity – $9 million

- Federal Emergency Management – $45 million

- Disaster Relief Fund – $45 billion

- Federal Assistance (Firefighters, Emergency Food and Shelter) – $400 million

Department of the Interior (page 709)

- Bureau of Indian Affairs – $453 million

- Bureau of Indian Education – $69 million

- Departmental Operations – $158 million

- Insular Affairs (Assistance to territories) – $55 million

- Environmental Protection Agency (science and technology) – $2 million

- Environmental Programs & Management – $4 million

- Buildings and Facilities – $300,000

- Hazardous Substance Superfund – $770,000

Department of Agricultural (page 715)

- Forest and rangeland research – $3 million

- National Forest System – $34 million

- Wildlife Fire Management – $7 million

Department of Health and Human Services (page 718)

- Indian Health Services – $1 billion

- Agency for Toxic Substances and Disease Registry – $12 million

- Institute of American Indian and Alaska Native Culture and Arts Development – $78,000

- Smithsonian Institute (salaries and expenses) – $7 million

- JFK Center for the Performing Arts – $25 million

- National Foundation for the Arts – $75 million

- National Endowment for the Humanities – $75 million

Department of Labor (page 726)

- Training and Employment Services – $345 million

- Department of Management – $15 million

Department of Health and Human Services (page 728)

- Center for Disease Control – $4.3 billion

- National Institute of Health – $103 million

- National Institute of Allergy and Infectious Diseases – $706 million

- National Institute of Biomedical Imaging and Bioengineering – $60 million

- National Library of Medicine – $10 million

- National Center for Advancing Translational Sciences – $36 million

- Office of the Director – $30 million

- Substance Abuse and Mental Health Services – $425 million

- Center for Medicaid and Medicare Services – $200 million

- Administration for Children and Families (Low Income Home Energy Assistance) – $900 million

- Payment to States for Childcare – $3.5 billion

- Children and Family Services Programs – $1.9 billion

- Administration for Community Living (Aging and Disability Services) – $955 million

Office of the Secretary (page 743)

- Public Health and Social Services Fund – $27 billion

Department of Education (page 752)

- Education Stabilization Fund – $30.7 billion

- Safe Schools and Citizenship Education – $100 million

- Gallaudet University (this is a university in DC for the deaf and hard-of-hearing) – $7 million

- Student Aid Administration – $40 million

- Howard University (Washington DC) – $13 million

- Departmental Management – $8 million

- Office of the Inspector General – $7 million

- Corporation for Public Broadcasting – $75 million

- Institute of Museum and Library Services – $50 million

- Railroad Retirement Board – $5 million

- Social Security Administration (administrative expenses) – $300 million

Legislative Branch – Senate (page 780)

- Sergeant of Arms and Doorkeeper of the Senate – $1 million

- Miscellaneous Items – $9 million

House or Representatives (page 781)

- Salaries and Expenses – $25 million (note that $5 million of this is expressly set aside for coronavirus related salary expenses).

Joint Items (page 781)

- Office of the Attending Physician – $400,000

- Capitol Police (salaries) – $12 million

- Capitol Construction and Operations (for purchase of cleaning and sanitization products) – $25 million

- Library of Congress (Salaries and Expenses) – $700,000

- Government Accountability Office (Salaries and Expenses) – $20 million

Department of Veterans Affairs (page 798)

- Operating expenses – $13 million

- Veterans Health Administration (Medical Services) – $14.4 billion

- Medical Community Care – $2.1 billion

- Medical Support and Compliance – $100 million

- Medical Facilities – $606 million

- Department Administration – $6 million

- Information Technology Systems – $2.15 billion

- Office of the Inspector General – $13 million

- Facilities – $150 million

Related Agencies (page 802)

- Armed Forces Retirement Home Trust Fund – $2.8 million

Department of State (page 816)

- Diplomatic Programs – $324 million

U.S. Agency for International Development (page 816)

- Funds for the President Operating Expenses – $95 million

Bilateral Economic Assistance (page 817)

- International Disaster Assistance – $258 million

- Migration and Refugee Assistance – $350 million

- Peace Corps – $88 million

Department of Transportation (page 831)

- Salaries and Expenses – $1.7 million

- Essential Air Service (in addition to “Payments to Air Carriers”) – $56 million

- Federal Aviation Administration (grants-in-aid for airports) – $10 billion

- Federal Railroad Administration (safety and operations) – $250,000

- National Railroad Passenger Corporation – $492 million + $526 million

- Federal Transit Administration (infrastructure) – $25 billion

- Maritime Administration (operations and training) – $3 million

- State Maritime Academy – $1 million

- Office of Inspector General – $5 million

Department of Housing and Urban Development (page 843)

- Administrative Support Offices – $35 million

- Program Offices – $15 million

- Public and Indian Housing (tenant-based rental assistance) – $1.25 billion

- Public Housing Operating Fund – $685 million

- Native American Programs – $300 million

- Housing Opportunities for Persons with Aids – $65 million

- Community Development Fund – $5 billion

- Homeless Assistance Grants – $4 billion

- Project-Based Rental Assistance – $1 billion

- Housing for the Elderly – $50 million

- Housing for Persons with Disabilities – $15 million

- Fair Housing Activities – $2.5 million

- Office of the Inspector General – $5 million

NOTE: this is a review of the Senate Bill. It appears the final signed law accepted all these items without change… although the final law does contain some additional funding not itemized here.

So, what do you think? Comment below.

Interested in financial and economic topics?… see my economic theory I wrote in November 2019. The world unfolded a little too close to the script. Or, you could just read about how I got lost in Ukraine.

P.S. Follow Past Midway if you would like an email notification of new posts.

FOOTNOTES:

The salaries thing was a bit much but am happy they finally passed that sunscreen resolution. Been waiting on that one for a while.

I want say a huge thank you, Andy, for plowing through this, for condensing it, & sharing even if it did cause my BP to spike (surely) & make me want to spend a little bit of those funds to get rid of those guys in DC who seem to have have lost touch with reality. We all know some shenanigans go on & they ALL “play the game”. But, seriously, this is beyond ridiculous.

Andy, amazing job on this. Thank you. It has been a long time; hope you are doing well.

I was a bit surprised by how much is going to Indian affairs given how small a part of the population they are. That said, it will probably do a lot of good.

So much going to things that have nothing to do with the virus or keeping the economy going. So much pork and pet projects – they saw an opportunity to put money places without the threat of being called out on it. Did anyone say no to anything?

If this exercise was embedded into a video game, you would have not only completed the hardest level, but simultaneously unlocked a super-nerd weapon. Something cool but whimsical, a quill-sword perhaps. (Surely you would also obtain teleporting or flight capability.) Well done, Andy. Your blog fans (count me) were instantly teleported through hundreds of pages of Congressional-speak. Wow. An eye-opener!

Thanks for doing this Andy. Scary how much of that seems to have absolutely nothing to do with the virus. It’s also amazing to me how easily this passed through Congress. We have politicians so scared about how much proposals for covering everyone with health insurance would cost that just easily let $2-6T get spent…primarily in the name of short-term healthcare and stimulus. The national debt continues to build…in good times (more tax cuts anyone?) and bad times.

I would like to thank you for taking the time to read and analyze the content of the Care Act. I enjoy all of your blogs, but this one is very impressive. It is truly an example of our fine politicians at work. That have been there a little long.

Great summary. If I were king for a day I would have said $X gets allocated to medical care and equipment in various forms, then every individual gets $Y in cash and $Z that they must donate to their choice of business, foundation, charity, or sunscreen maker. Then I would sit back and watch the funds flow where they naturally would and let these various entities compete for attention and popularity. Given how quickly this has come about, special interest groups that are already skilled and getting government funding have likely benefited disproportionately well compared to those that have no advocacy groups in place. I realize this is easier said then done. Also realize I need a shower badly. Not leaving the house for a few days makes me chronically procrastinate personal hygiene, other than hand washing.

Thank you for doing this Andy! If you don’t mind, I’d like to share it. Frustrated & shocked are just two of the things I felt reading through it. Appreciate all of your work on this! Hope you are doing well.

Amy,

Thanks for commenting. Absolutely share this broadly.

I spent the evening going over the final signed CARES law and putting all the values into Excel. I’ll post this as an update within the hour.

Andy

Absurb…absolutely nothing to help small guys like us who are self employed that not even able to be classified as small businesses. SMH.

Andy, Thanks for this effort. I admire you for your dedication, patience and your perseverance for wading through this. I wonder how many of our elected officials read it I completely. I am not an economist but am concerned about our national debt going forward. I pity our grandchildren and their children who will have to figure out ways to pay for all this.

I see that our 2020 RMD for us old folks has been eliminated. Which is great for those that do not need it but no benefit for those that need it anyway for living expenses. If they would have waived the tax as in ROTHs it would have been more helpful. Will we have to make up for that in 2021?

Thanks again.

While I don’t have the time or desire to make a spreadsheet like you did (but do admire your dedication to this), a couple of things stick out: 1) Sunscreen. Thank God we are finally throwing money at such a bain to our society. I’ve been lobbying legislators for years over this. (Not really. I truly don’t care about sunscreen.) 2) Money for Native Cultural Arts or yadda yadda. $75,000. Really? Such a trivial amount. If I were of the Native culture, I might be a little offended. And 3) Salaries for both the House and Senate. Soooooo disappointing. Since you love spreadsheets, can you tell us who voted yay or nay for this? I’d like to know who to boot from office at the next election cycle.

But this was great. Thank you for taking the time to work through it all. I’ll definitely be sharing.

Thank you for your comment. Just to clarify, the total funding allocated to Native Americans from this Act is $3.8 billion, spread out across 8 items. But yes, the $78,000 for the “Institute Of American Indian And Alaska Native Culture And Arts Development” is the single smallest item in the Act. I should also note that the single largest item goes unnoticed. This goes to “Reauthorization Of Health Professions Workforce Programs” which apparently has unlimited funding. The exact quote for funding this item is, “such sums as may be necessary for each of fiscal years 2021 through 2025.”

Thank you, very impressive and this is really helpful!

A related update (June 2022)… it occurred to me that I should also read the law that allocates $40 billion to Ukraine, titled:

“H.R.7691 – Additional Ukraine Supplemental Appropriations Act, 2022”

Here’s the source if you also want to read it:

https://www.congress.gov/bill/117th-congress/house-bill/7691/text?q=%7B%22search%22%3A%5B%22ukraine%22%2C%22ukraine%22%5D%7D&r=2&s=2

Based on the CARES Act, I assumed the Ukraine Bill would also contain copious amounts of pork. However, I am happy to report, it did not. While it was a significant military spend, I did not see any categories or line items that were obviously not associated with a relief effort to Ukraine.

This does not mean that all of the $40 billion will find its way to Ukraine. Much of the money might just stay in the U.S. military budget, categorized as “to respond to the situation in Ukraine and for related expenses”. That’s a little vague. But, at least there were no line items in this Bill completely unrelated to potentially supporting Ukraine… to my surprise.