Although Covid, money printing, inflation, and geopolitical complexities dominate the media and our collective conversation, we seem to have lost focus on the Social Security Program.

Why? Because it’s boring, in comparison.

Nevertheless, a Social Security implosion looms on the near horizon. Consequently, I thought we should resurface this conversation, between panics.

The main problem,

Social Security is severely underfunded

relative to projected outlays of capital promised to the people who have paid in all these years.

Rewind

When I was about 10-years old (early 1980’s), the adults within my periphery discussed the eventual problem with social security. I likely retained this esoteric, childhood memory because they said,

“Andy, by the time you are 65, there won’t be any money left.”

“Wait… what?”

I wasn’t exactly sure what all those words meant, but I did understand no money and it didn’t sound so swell.

“Social security payments won’t be sustainable when all the baby boomers retire.”

“Why not?”

“There’ll be too many of us, relative to the workers paying into the Program.”

An explanation ensued about what this means. Well, as best one can explain economics and esoteric government programs to a 10-year-old knucklehead, which was me.

Back then, the problem was sufficiently distanced in time that we could safely call it, not urgent. We had time to solve this conundrum. Surely someone would step in with a great idea and save the day… sometime in the next few decades, two times my life span!

In the meantime, we had more pressing issues to worry about – a cold war between nuclear-enabled superpowers, acid rain, HIV, just saying no to drugs, Japan buying all the U.S. assets, and playing Defender on our Atari. All important stuff. I mean, just look at these graphics…

These were serious times. Just as critical as all the things we are told we need to worry about today. New issues. Same level of grave concern.

Meanwhile, looming on the financial front, events would unfold that few people were concerned about in the early ‘80s – a Savings & Loan crisis (1986), a stock market crash (October 19, 1987… down 22.6% in one day), market corruptions of the junk bond variety (1989), and run-away inflation.1

Sometimes we focus on that which is most immediately in front of us and neglect to identify or act to correct events on the horizon while we still have time, things so obvious in retrospect.

Back to the Present

My point – we have known of the eventual demise of the Social Security program my entire life.

Now, some forty years later, the problem isn’t so far into the future. In fact, it’s right in front of us. We waited so long to face the problem; it outgrew any moderately painful fix we might devise to patch it.

Let’s talk hard numbers for some perspective.

When it comes to research, I prefer to go direct to source-data to form my views. In this case, the source data is the Social Security Administration’s annual report itself, which we will now visit.

Social Security Annual Report

The annual report published by the Social Security Administration2 is formal, but it does not mince words in describing the urgency of the situation.

Most people do not particularly enjoy reading dreary financial reports, even on a rainy day. Allow me to save you that time, and get to the main point, as I see it.

But first, a quick caveat…

The issue isn’t with the Social Security Administration (SSA) itself. The SSA is comprised of regular people tasked with managing the mammoth Social Security Program according to the law – the regulations bestowed upon them by lawmakers.

From what I can tell, the SSA’s staff do a pretty good job of it.

To be clear, when I say “staff”, I am referring to the 60,000 people we employ to manage the administration of our social security program from their 1,246 offices around the country.3

That’s an enormous expense-load of staff and office space, a huge operating cost in absolute dollar terms. But then, the SSA’s flow of funds is equally enormous.

It sounds odd to say a government program runs efficiently, but, as a percentage of funds, the expense-to-administer social security in the United States is surprisingly low, and gains efficiency over time.

This cost-to-administer metric is what I use to base my assessment of the quality of work being done by the SSA itself.

Here are some metrics on the costs to provide their service over time:

- In 1957, the cost to manage social security was 2.2% of funds collected. It stayed at that level for about 20 years.

- In the early 1970’s, the administration’s overhead began to decline in percentage terms, dropping to 1% in 1989, where it stayed until 2011.

- Over the next 10 years (2012 – 2021), the cost to administer our social security program steadily declined to 0.6%, where it now stands (the last reported year).

Impressive really.

A reduction in percentage-cost implies management is focused on operational efficiencies, most likely through better use of technology. Computer sweat costs less than human sweat.

So, it seems the SSA cost-effectively collects, invests, and distributes money from all around the country.

I mention all that to be clear where I believe the problem resides… not necessarily with the SSA.

The problem is with our lawmakers.

Lawmakers set the rules, mostly designed to defer, demur, and pass to the next generation of politicians. However, we are nearing the end of the road, and the can is no longer its former self, from all the kicking.

End caveat, back to the SSA Annual Report…

A key section of the Social Security annual report/audit is found on page 28 under the heading “Long-Term Financing”. Here’s the exact quote:

Social Security’s financing is not projected to be sustainable over the long term with the tax rates and benefit levels scheduled in current law. Under the intermediate set of assumptions of the 2021 Trustees Report, program costs will exceed noninterest income in all years of the 75-year projection period. The combined OASI and DI Trust Fund reserves are projected to be depleted in 2034. Tax revenues are projected to be sufficient to support expenditures at a level of 78% of scheduled benefits after the combined OASI and DI Trust Fund depletion in 2034, declining to 74% of scheduled benefits in 2095.

The primary reasons for the projected long-term inadequacy of financing under current law relate to changes in the demographics of the United States: birth rates dropping substantially after 1965, retirees living longer, and baby boomers beginning their retirements. In present value terms, the 75-year shortfall is $19.8 trillion, which is 3.35% of taxable payroll and 1.2% of gross domestic product over the same period. Some of the possible reform alternatives being discussed – singularly or in combination with each other – are:

- Increasing payroll taxes;

- Slowing the growth in benefits;

- Finding other revenue sources (such as general revenues); or

- Increasing expected returns by investing the OASI and DI Trust Fund reserves, at least in part, in private securities.

Social Security is both broken and going broke.

That’s the long-term outlook. Because it’s long-term, it may not seem all that dire. I mean, 75 years into the future is pretty far out to make projections with any reliability. Can you imagine projections of our world today based on an analysis performed in 1947 (75 years ago)?

Because a 75-year forecast is perpetually distanced from us in time, it seems like someone else’s problem. Sucks to be those guys (that is, our future selves).

Except, the SSA is saying the reserve fund will fully deplete to zero in 2034, only 12 years from now.

To be clear, social security is a “pay-as-you-go” system. Current income is used to pay current (same year) outflow. That is, the money taken out of your paycheck right now for social security is not set aside in a little fund with your name on it, just waiting for you to retire some day in the future, when they then reverse it, and drip the money back out to you.

There is no lockbox with your money in it.

Instead, the money you pay in this year is immediately distributed to someone currently receiving social security benefits, this year.4

In fact, the SSA says as much in their documents that explain how it works:

The money you pay in taxes isn’t held in a personal account for you to use when you get benefits. We use your taxes to pay people who are getting benefits right now. Any unused money goes to the Social Security trust funds, not a personal account with your name on it.5

In turn, when you retire, part of someone’s paycheck should go to you.

The challenge arises if the income collected for social security is less than the outflow promised to the populace, which is now the case (this started in 2020). In theory, this delta can be bridged from the existing social security fund, but only as a temporary measure. Certainly not for 75 years. Apparently, the reserve fund can only bridge the gap for 12 years, at current gap-disparities.

After that, according to the SSA annual report, without a reserve fund to make up the difference, there can only be a 78% payout, relative to what you have been promised. Basic math.

As it stands, those turning 67 in the year 2034 are now 54-55 years old (in 2022). Consequently, if you are “55 and under”, for you, we might need to rename the program Social Semi-Security.

The Short-Term, Immediate Problem

There’s another point to discuss.

Because the SSA now has costs in excess of income (first time in the history of the program this happened was in 2020… the 2nd time was 2021), the reserve fund is depleting. In fact, it depletes completely to zero in 2034 (as mentioned above).

If nothing changes, the social security reserve fund will be completely bust in 12 years. After that, the SSA can only pay out what comes in, a 78% benefit. Oops.

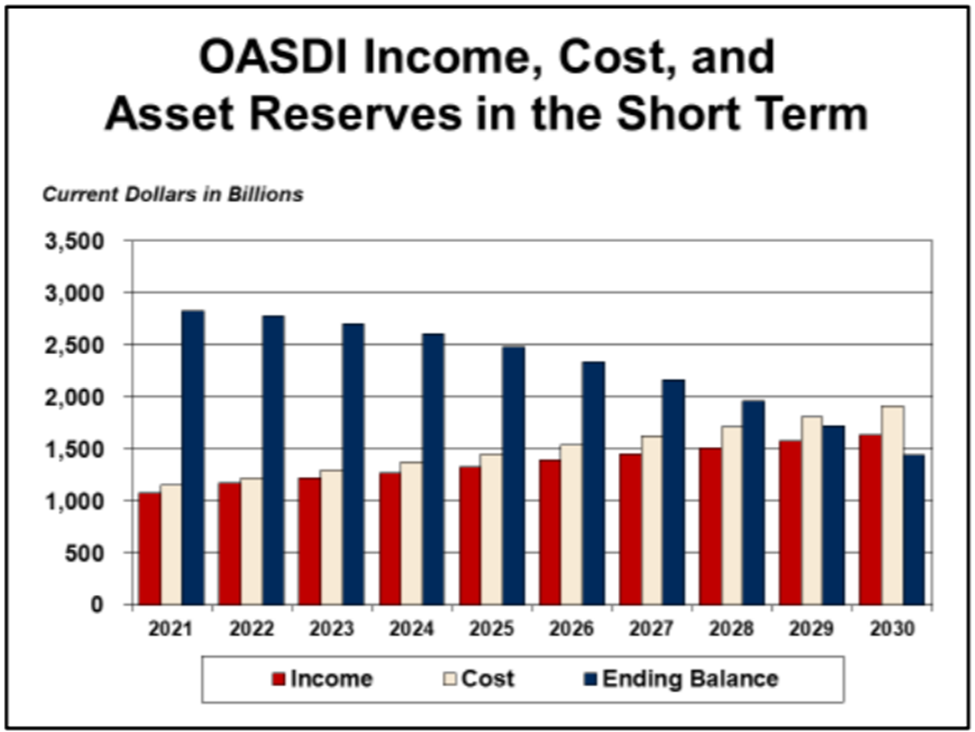

Here’s the graph from the annual report showing the projected near-term depletion of the social security trust fund.

But there’s good news… just kidding.

The Worse News

You might think it’s bad enough that Social Security is quickly going broke and that lawmakers are ignoring it, even though they know about it. But it’s worse than you might think.

There’s really no money in the trust fund anyway… because politicians already pilfered it.

If you are like most people, when you think of the Social Security trust fund, you might imagine a bank account with a huge balance.

Maybe you could walk up to an ATM with that debit card, enter the pin code, and see your balance with $2,700,000,000,000 (that’s $2.7 trillion). Fantastic!

But instead, it shows $0.

How can this be?

The reality is, politicians said, “There’s a load of free money over there in the Social Security Trust Fund, just sitting there. That thing runs a surplus every year. Let’s spend it, and in the place of the money, let’s drop an IOU note instead.”

And that’s precisely what happened.

Perhaps you might try to rationalize it as follows:

“That’s fine. This IOU note just shows up on our balance sheet as debt and the government simply repays it as it becomes due because, essentially, the government just owes money to itself.”

But you’d be wrong.

The pilfered money out of the SSA Trust Fund does NOT show up on the national debt. This is what is referred to as “off-balance sheet debt”.

That’s a fancy way of saying, “We’re simply not counting it when we report our official National Debt figure.”

This is mostly because it looks bad. Scary even. And might be alarming.

So, lawmakers (politicians) grabbed the cash, spent it, and left future retirees a dubious IOU note in place of the money.

Inflation

This brings me to my next point.

The U.S. debt is so astronomically high with “on balance sheet” debt that it has become untenable. And yet, the “off balance sheet” debt is several FACTORS LARGER than the on-balance-sheet debt. It’s just not reported nor discussed.

If you think about your own household, there are only a few ways to handle your debt.

- You pay it down. To do this, you either need to make more money or cut some expenses to free up cash. In SSA terms,

- “make more money” is equivalent to increasing tax withholdings from paychecks.

- “cutting expenses” is equivalent to operating more efficiently. However, as already discussed, there’s not much by way of expenses to cut from the SSA operating budget.

- You renegotiate the terms.

- This will almost certainly be part of the program going forward (as it has been in the past). Retirement age gets pushed up, as it likely should. People live longer now and work longer as well.

- You don’t pay it and declare bankruptcy.

- This isn’t a viable strategy for the U.S. government, equivalent to global economic meltdown.

These options also exist at the government level, plus another option you don’t have as a household – devalue your currency.

However, the government can’t devalue the currency in one go as other countries have done (by defaulting on their debt obligations). Why? Because this also leads to global economic meltdown. Instead, politicians devalue the U.S. dollars deliberately over time… by creating inflation… on purpose.

As far as I can tell, that is really the only viable solution, to painfully inflate our way out of this financial pickle.

If you think the high inflation we are experiencing now is caused by all the money printing, you’d be 100% correct. If you think this is in any way related to Covid, you’d be almost completely wrong.

Covid was simply the convenient excuse lawmakers used to print money, because it’s the only recourse we have that does not end in financial insolvency.

I’m not one to speak in hyperbole. There’s just no getting around the basic math of the situation. Few in the federal government will say this aloud, for fear it might cause fear. And fear itself can wreck the whole system. So, instead, we’ll drown slowly.

Print money. Create inflation. Inflate our debt away.

Addendum – on Inflation

Here’s a short addendum to better explain how inflation effectively makes debt more palatable for future payoff at the expense of certain people; low-income earners and people who saved and made conservative investments.

Imagine your grandparents bought 160 acres of land in Oklahoma in the 1940’s, like my grandparents did. Maybe they paid ~$15,000 for the property.

Sounds inexpensive, but back then, that was a lot of money.6

Suppose, hypothetically, they took a 75-year interest-only loan on that $15,000 purchase. Obviously, they didn’t, but suppose they did. If you later inherit the land (and the loan) and wanted to payoff that loan today, it would have a $15,000 balance (it was interest only, so the principal was not reduced). Well, $15k doesn’t seem like much for 160 acres free and clear.

Why?

Because the value of the dollar depreciated over that time, but the loan was a fixed amount. The underlying loan amount does not change with inflation. We therefore get to pay off a fixed loan amount with inflated dollars… dollars of lesser value.

This is the same concept with our national debt. If we inflate the dollar – a lot – we might just be able to afford the debt we’ve already incurred, because we can pay it back (in the future) with inflated dollars of lesser value. That is, the repayment will feel “cheaper” in the future, just like our hypothetical farmland loan… largely at the expense of the person who holds the loan (the person or entity that made a conservative investment).

OK. If that’s so easy, why don’t we print more money, inflate away, and be in better fiscal shape?

Several reasons…

Inflation is essentially a tax…

A tax that most adversely affects those with fixed incomes (the elderly on social security), lower income people, and hourly wage earners.

Inflation significantly reduces the quality of life for those most financially vulnerable.

High inflation usually outpaces the eventual rise in incomes. Obviously, that’s not good, primarily because those just scraping by are no longer able to afford basic necessities.

Lawmakers will just spend more…

Inflation may create a mechanism to pay our debt over time with depreciated dollars, but unfortunately, politicians will likely see this as a way to spend even more.

Sounds cynical. I know. But echoes of history inform us that

politicians value votes over fiscal responsibility.

“We need to either raise your taxes or decrease your benefits, or both,” said no politician ever on the campaign trail.

That candidate would never get elected.

Instead, politicians promise more benefits to win votes, then print more money to effectively tax everyone for the uncontrollable spending.

There are limits to this model, I think.

Fatal Flaw

More fundamentally, I fear this is the fatal flaw of democracy, conceptually. That the people, not sufficiently astute in basic economics and finance, will predominately vote for lower taxes, more benefits, less work, more handouts, and more entitlements, until the system crumbles upon itself, because those receiving benefits begin to outnumber those who are productive.

Your thoughts and comments?

- I recall 15%+ interest on my checking account in 3rd grade. Dad made my brother and I figure our interest every month, by hand, to ensure we understood how it was calculated.

- Source: The Social Security Administration’s Agency Financial Report for Fiscal Year 2021

- Source

- Shockingly, 69.8 million people received SSA benefits in 2020 [Source], out of a total population of 329.5 million (21% of the entire population). That figure was 19% in 2019. [Source] I’m sure you see the problem. In case you are curious, ~85% of your paycheck withholdings go to retirees while ~15% go to those with (presumed) disabilities.

- Source: Social Security Today & Tomorrow – Understanding Your Benefits

- ~$300,000 inflation adjusted.

This is an excellent description of the problem without getting into the tribalism aspects of political parties. Well-stated and fact-driven. We often have politicians that run on “fixing social security” or being for “fiscal responsibility”. The problem becomes that none of them do anything once they are in office because it is either (1) negative for their prospects of getting reelected, or (2) even if those politicians only say they are in it for “one-term” to fix problems, they have tremendous pressures from their own parties and lobbyists to not fix the problem.

We need an appointed group of bipartisan independent economists to both (1) fix the problem AND (2) take the blame from political parties for fixing the problem (and the resulting downsides that come with that fix). This both fixes the problem and gives politicians someone to blame in their 10 second sound bite culture.

As always, informative and easy to understand. I like the slight sense of humor at the beginning to suck me into that depressing void. 😉

Well written! Thank you. I think….

Excellent article. Footnote 6 touches upon something that serves as a strong undertow in all of this. A staggering 15% of the funds are allocated to “disabled” Americans, through the SSI program. According to the Social Security Administration, SSI pays “people with limited income and resources who are disabled, blind, or age 65 or older.” I found a graph that shows the allocation of SSI funds by year and age group. Current data covers 1974 to 2019. You can access the graph here:

https://www.ssa.gov/policy/docs/chartbooks/fast_facts/2020/fast_facts20.html

Note the spike in SSI-eligible claimants in WORKING-AGE adults (ages 18-64). This is an alarming trend, and a barometer for a far bigger problem. I suspect this trend will increase at the same rate (or worse) with time. In short, there are more “takers” than “makers” today than ever before. Worse, the largest number of SSI “takers” are not the intended demographic. That’s a double-whammy.

I have two final observations that stem entirely from my own personal experiences. First, as a trial lawyer who defends car crash cases, I have observed a large number of “repeat offenders” (those who file lawsuits, claim “disability,” and receive relatively large paydays). Many of these claimants are already receiving SSI disability. Most are young. Secondly, as a former enlisted soldier in the Army, I have observed a spike of disability claims by veterans. Most such claims are legitimate, but a great many are not.

So, while I wholeheartedly agree that politicians are to blame for gross mismanagement of the “family funds,” I think the root problem hits a little closer to home. Stated another way, the day that the group of voters who want a handout exceed the group of voters who are willing to work, this country starts the downhill skid. I believe we passed that mark a couple of years ago.

Paul – thanks for the great comment.