When I was completing my MBA in Finance at the Stockholm School of Economics in the late 1990’s, the rumor was that one of our professors had discovered a pricing anomaly in the Stockholm Stock Exchange and had made a sizable amount of money in a pure arbitrage play. Because the details were scarce, I wondered if this was true. And, more importantly, why can’t this happen to me? It did. Read on…

Pricing Anomaly

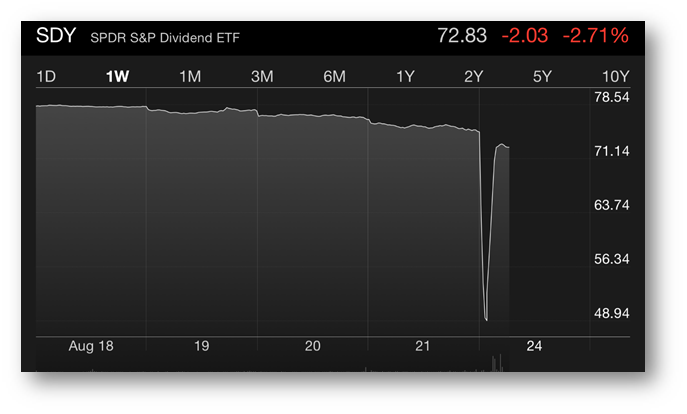

In August 2015, I was checking the market and was surprised to see that the SPDR S&P Dividend exchange-traded fund (ticker: SDY) was trading down ~34% for the day.

SDY tracks the performance of the highest dividend yielding S&P Composite 1500 Index constituents.1 Consequently, it’s quite stable with relatively low volatility. SDY trading down 4% in a day is a large move. Down 34% in a single day was highly unusual (in fact, nearly impossible), inviting further investigation.

I quickly looked at the S&P 500 index tracking stock (SPY) to see if it was trading down as well. It was not. Strange. SPY is a good gauge of the overall market sentiment. How could SDY be off 30% and SPY be flat? Considering the biggest positions in SDY represent only ~2% of the portfolio, it’s not like the demise of a single stock would bring SDY down more than a few percentage points. It seems mathematically impossible this type of price discrepancy could exist between SDY and SPY… especially since the SDY stocks are a subset of some of the largest stocks in SPY.

It occurred to me that this might be an arbitrage opportunity (long SDY, short SPY and wait for them to re-converge).2 Given that these are two of the biggest, most widely-traded ETFs on the market, I made the reasonable assumption that I was the schmuck with the least amount of information, that the market obviously knew something I did not, and by placing this trade, I would become the donkey. No one wants to be the donkey, including me.

Consequently, I did not place a boxed trade to capture what appeared to be a near riskless gain. Within 20 minutes, SDY bounced back up on heavy trading volume and the two ETF’s converged again. It was simply a pricing anomaly that I happened to see in real-time. I took a screen print of SDY after the prices re-converged.

See if you can spot the subtle dip and rebound in the chart below…3

Not so subtle, is it? Looks like a cross-section of the Grand Canyon, except the people at the bottom aren’t hiking, rafting and having a good time.

Kicking Myself

I have since kicked myself repeatedly for missing this nearly-pure arbitrage opportunity. Something like this may only cross my path once in a lifetime… especially to spot it and recognize it for what it is while it still exists. With an options trade, I probably would have made 25x on my money in 20 minutes. Perhaps 50x with leverage. I should have put my entire net worth into this one trade, leveraged… and just retired… and lived like a rock star. But alas, that was not to be my future.

Kicking Themselves Harder

At least for me, this was only a missed opportunity. If institutional buyers took advantage of this arbitrage opportunity by buying (and it appears they did by the trading volume), then, by definition, someone was selling… at the minimum. Ouch. Those are the people who truly have a reason to kick themselves. Perhaps they freaked out at such a huge price decrease and bailed thinking the financial world was collapsing. “The sky is falling! The sky is falling! Sell! Sell! Sell!”.4

Aside – Efficient Markets

If arbitrage trades exist in the public markets, what does this say about the theory of efficient markets? Is the market efficient or not? This is a highly debated topic with smart, highly credentialed people on both sides of the argument.

In the interview “Are Markets Efficient?”, Nobel laureate Eugene F. Fama and Richard H. Thaler (both members of the Chicago Booth faculty) discuss how markets behave (and misbehave).5 Two of the leading academic thinkers on the efficient market hypothesis hold completely different opinions. One believes that the markets are efficient. The other believes the opposite. To their credit, both seem to acknowledge they cannot support their respective positions with absolute certainty.

I do not pretend to bring anything new to this debate that the world’s leading experts haven’t already covered. But my personal observation of arbitrage supports my view that the financial markets are “less than efficient”.

“Less than efficient” means… mostly efficient, most of the time. But there are anomalies and short-term discrepancies that do occur, like the event described above and flash crashes attributed to glitches and group-think in algorithmic trading. Because these exist, I must conclude the markets are not fully-efficient.

A Cautionary Note

Before you quit your job to trade arbitrage, I should note… it’s very difficult to take advantage of these irrational blips and glitches in real-time unless you are a professional trader. It takes a lot of confidence to make split second decisions that effectively say you believe you are smarter than the entire market, sufficiently in-the-know and not the donkey.

Don’t be the donkey but don’t be Chicken Little either.

P.S. Follow Past Midway if you would like an email notification of new posts.

FOOTNOTES:

- that have followed a managed-dividends policy of consistently increasing dividends every year for at least 20 consecutive years.

- Technically, I would have bought PUT options on SPY and CALL options on SDY to enhance the leverage and magnify the outcome.

- The increased trading volume would be others that also noticed this anomaly and actually took action, unlike me.

- Chicken Little reference. And appropriate, because the market ate them. Incidentally, the English version of Chicken Little is translated from the Danish version “Kylling Kluk” who said, “I think the world is falling.” Apparently, versions of this story date back 25 centuries. Sounds about right… human nature always has someone running around telling people the sky is falling. Today, we call it “The News”.

- While I thought this video was super engaging, I don’t recommend you watch it unless you’re a real nerd like me.

Interesting…especially in light of the fact I am personally about as far removed from the market as one can get, & my business ‘smarts’ extend about as far as balancing the checkbook…but, extrapolating human nature from the event described & giving sage advice? Now, that makes perfect sense.

There’s no way I could work in your field. I don’t have the nerves for it. Blood, guts, bodily secretions don’t make me blink. My 401k that I had just rolled over from my state retirement account lost $10,000 the first week. I just about died. I almost had to call a code on myself. Thank God for people like you.

Just to clarify, I am not a professional trader. This story came about as I was just screwing around watching the stock market one morning at the office… instead of actually working.

Interestingly, from my MBA macroeconomics lecture this week – “The stock market is not the economy but it is not not the economy either …” ~Some Pundit Ha!

Brilliant comment… wish I had said it.